By Janet Sellers

Imagination is available at all times; using it to be creative and make something is a highly developed and valued skill.

Art has an effect on viewers and collectors, and they seek to revisit the realms the artist brings as a kind of portal for them. We all experience this kind of portal idea when we read books or watch television and video games or use visual and sound media to engage with ideas and our imagination. The artist creates a pathway from our day-to-day life to the realm of imagination, bringing it to us physically from their adventures in imagination via art creation.

Art is decoration, a statement, ritual equipment, ornament, entertainment, and more. Art is the imagination made visible and tangible. We can make it ourselves, we can buy art as investment, and we can even buy fractional shares of art as investment and earn a return when the art sells.

In the last year, among the top 10 smart and safe investments with a whopping 10 percent return listed by the investment firm Lion’s Wealth Management, art is No. 4. Art is an investment to enjoy seeing every day while it creates a return. It also appreciates in value independently of other investment indexes like security indexes and inflation.

This begs the question of which level of art is investment worthy and how is that determined and discerned? Frequently, investors use the secondary art market for investment levels, and the cognoscenti (literati) invest in the primary art market. What are those?

The primary art market is the first purchase of a work and usually lower in price than when the artwork is resold, which is known as the secondary market. Artworks can be resold often, but it is likely that the collector buys the artwork because they like to see it or know they can share it via leasing or other ways for shows at museums and events.

These primary and secondary art markets are closely intertwined, and the best way for people to understand the investment value, as with any investment, is educating themselves about the art, artists and the stability of the artists’ works and the art prices. The secondary art market tends to be more stable but as in any market, the seller, be it at auction, private sale, or a gallery sale, looks to make the highest return possible. Just as in any business, an artist’s artwork sales need to go up to show confidence, stability, and profitability for investment status. Even so, art for art’s sake and art for personal pleasure are still investments to enjoy and brighten our days.

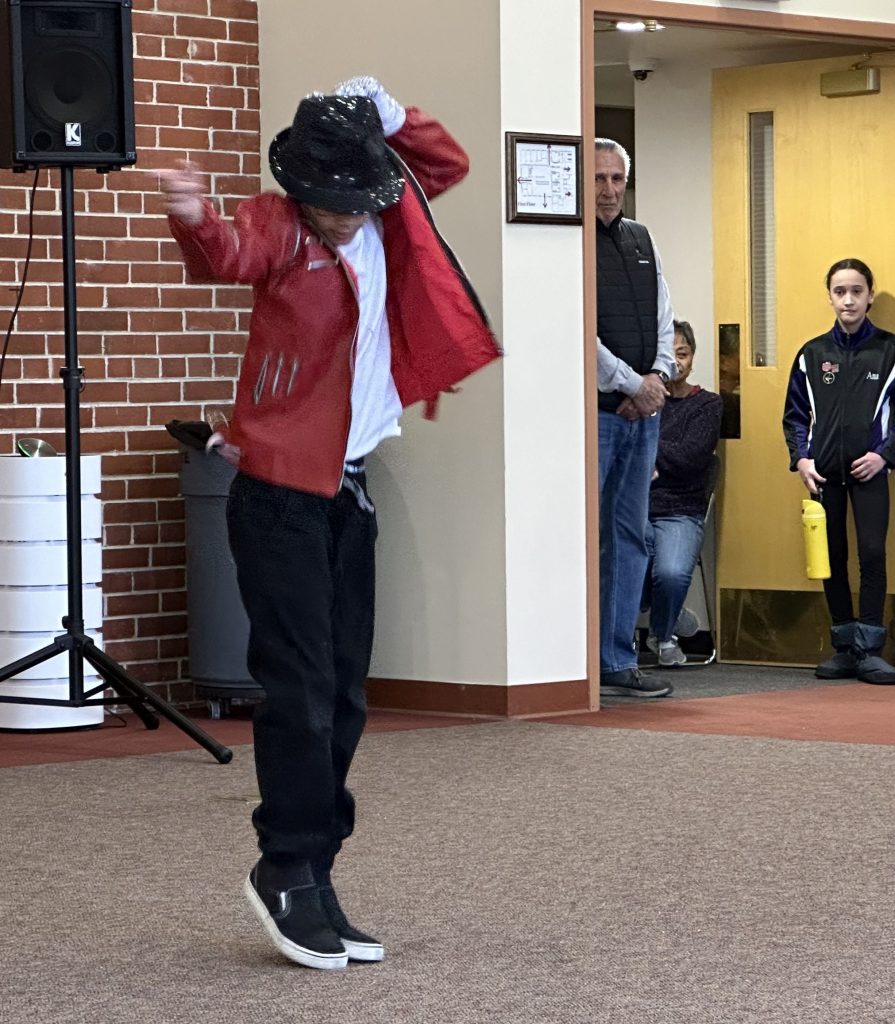

News flash! This year, our Art Hop season will change from Thursdays to Fridays and include music, food, and more. Stay tuned!

Janet Sellers is an artist, writer and speaker who makes and shares her artworks locally and nationally via galleries, writing, and talks on art and making things. Contact her at janetsellers@ocn.me.

Other Art Matters articles

- Art Matters – It’s not just decor: Art creates a space and creates our sense of place (11/2/2024)

- Art Matters – October is Arts Month, aka Artober (10/5/2024)

- Art Matters – Real local art made for real people (9/7/2024)

- Art Matters – On the superpowers of art and daydreaming (8/3/2024)

- Art Matters – Chautauqua: “the most American thing in America” (7/6/2024)

- Art Matters – Spring and summer’s Art Hop: art and play (6/1/2024)

- Art Matters – Art multiples: slabs to electronic screens; Art Hop rides again (5/4/2024)

- Art Matters – The most beautiful investment and tax deduction (4/6/2024)

- Art Matters – Fine art offers valuable returns (3/2/2024)

- Art Matters – Ikigai: connecting to creative genius (2/3/2024)